[Sponsor]

Your Parent’s Estate Plan: Made in the 80’s… Out of Date Today!

by Darlynn Morgan,

Orange County Estate Planning Lawyer

As with anything from the 80’s… hairstyles, clothes, VHS, cassette tapes, fads and trends, rest assured that mom and dad’s estate plan is probably right up there with shoulder pads: painfully out-of-date!

If you take the time to ask your parents if they have an estate plan, you may find them proud to say that they have a will or trust. They probably feel confident knowing that at some point in their lives, they created legal plans to do the right thing by their family…

…or did they?

When to Update an Estate Plan

Even if mom or dad HAS a will or trust, your next question to them should always be, “when is the last time you UPDATED your plan?”

What you’ll likely find is that the documents mom or dad created in the 80’s, or even earlier, have simply gone untouched and unaltered as their life (and the law!) have changed through the years. And guess what?

That great plan made decades ago is now likely worthless and out-of-date!

It’s not unusual for parents to create plans while their kids are young and then stick it in a drawer believing it’s good forever. But again, the way your family’s life looked in the 80’s is probably not anything near what it looks like today:

You, your brothers and/or your sisters are now grown up. Those documents that name who could raise you if something happens to mom or dad really don’t apply any longer.

What about the issues facing your parents TODAY?

1. HIPAA laws didn’t exist. There are likely no documents in place that would allow a doctor or hospital to speak to someone else on your parents’ behalf if they become sick or incapacitated for any reason.

2. Grandkids! If you were just a kid when their plan was created, then you know for sure the grandkids have been left out of the picture.

3. You are probably NOT named as their power of attorney. Again, if you were just a kid when they made their plan, if they had a power of attorney, they likely named someone else. That person could live thousands of miles away now or might have even passed away. Another worthless document in the pile.

4. The laws are different. For example, a lawyer who created a plan in the 80’s had to account for more complicated tax laws that caused a lot of aggravation after the first spouse passed away. Most of these are not an issue today and plans can be changed to protect the family from unnecessary expenses, court drama, and lRS headaches.

5. Institution requirements have changed, too! After a few years, legal documents often go “stale”. Most banks or institutions will no longer accept powers of attorneys and other estate planning documents created longer than three years ago. The old documents your parents have would likely be rejected if you tried to use them.

Eye opening, isn’t it? And, these are just a HANDFUL of concerns. Let’s not forget that mom or dad’s assets are probably way different now than what they owned when you were young. There may also be health concerns to worry about, retirement planning to deal with and so much more. If your parents’ plan doesn’t account for all of these issues, you and/or your family members will find yourselves in a lurch when a crisis happens.

So what should you do?

The first step is to have them pull their old documents out of the drawer, dust them off and give them a look through. It shouldn’t take long for them to identify if the life they planned for in their documents is way different than the life they lead today.

The second step is to get educated! Don’t allow them to start hand writing changes on their documents! They won’t likely hold up in court anyway. Instead, empower them to take back control of their legal and financial affairs by becoming educated about what needs to be done today.

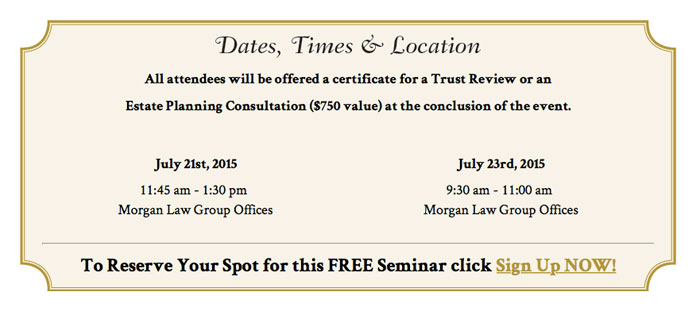

Tuesday, July 21st, 2015

Morgan Law Group Offices

11:45am – 1:30pm

Thursday, July 23rd, 2015

Morgan Law Group Offices

9:30am – 11:00am

I walk attendees step-by-step through everything they need to know about estate planning in a straightforward and easy-to-understand way. There’s no pressure to buy legal services either, so mom or dad can relax, gather their facts and begin to make a better plan to protect themselves, their assets and the people they love.

Send them to www.OCPlanningSeminar.com or call (949) 260-1400 to reserve them a space as it is limited.

Finally, UPDATE the plan! When your parents are ready, have your documents officially reviewed by an estate planning attorney. If you need help with this step, simply contact my office at (949) 260-1400 and ask to schedule a Trust Review.

These sessions are normally $750, but because you’ve come this far in learning how to help your family, I will waive 100% of the fee.

Just mention Tiny Oranges!

Do what you can now to help them out while they are still in good health and in the right frame of mind to make changes. Getting up to speed in the new millennium with their planning will likely save them thousands (…and in some cases, millions!) of dollars and a ton of aggravation during the remainder of their life, and for your family after their passing.

P.S. If YOU haven’t yet had a chance to get your own planning in place, then we have two seminars geared just for parents with small children, whose focus is on ensuring that the kids would be totally protected under every circumstance. Join us at Once Upon a Story Book or Granola Babies in July for FREE. Register now at http://kidsprotectionworkshop.com/.

This is a great reminder! I’m thankful for parents that are really intentional about keeping things updated because they know it will make it easier for me. I wish everyone did this!

It is something you don’t really think about – so I am so glad Darlynn did this post as a reminder! I sent it to my parents as a reminder too. 🙂